Start saving and make the most of your money with competitive interest and other benefits.

Individual Retirement Accounts (IRAs)

Pay the future you, for all of your hard work.

An Individual Retirement Account (IRA) is a tax-advantaged retirement savings account.

Types of IRAs

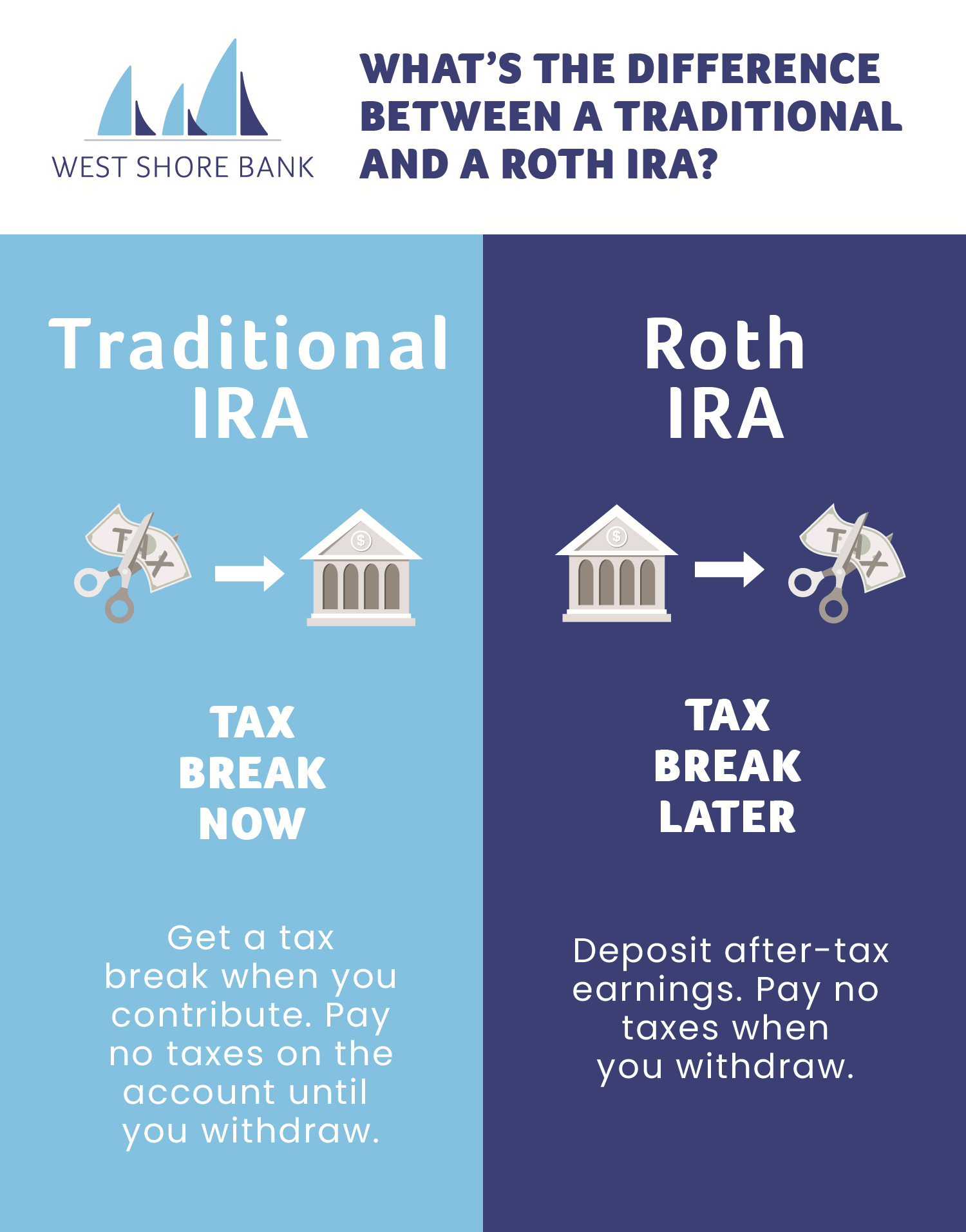

Traditional IRA

Contribute pre-tax dollars up to the annual limit. Earn interest on your IRA balance. Withdrawals in retirement are taxed.

Roth IRA

Make after-tax contributions up to the annual limit. Enjoy tax-free earnings and withdrawals.

Coverdell ESA

A type of education savings account that offers tax-free withdrawals for qualified education expenses. Earn interest on your funds to help pay for your child’s future education.

Traditional IRA vs. Roth IRA

Individual Retirement Accounts (IRAs) Rates

| Term | Fixed or Variable Rate | Minimum Balance* to Obtain APY | Interest Rate | APY (Annual Percentage Yield) |

|---|---|---|---|---|

| 12 Month IRA | Fixed | $500 | 2.00% | 2.02% |

| 24 Month IRA | Fixed | $500 | 2.50% | 2.52% |

| 36 Month IRA | Fixed | $500 | 2.50% | 2.52% |

| 48 Month IRA | Fixed | $500 | 2.50% | 2.52% |

*Daily Balance (the amount of principal in the account each day).

Withdrawals from certificates of deposit prior to maturity will be assessed early withdrawal penalties.

See Deposit Account Disclosure for more details.

Open An IRA!

Since 1898, West Shore bank has e remained committed to helping the people and businesses along the lakeshore to improve their financial well-being. Contact us today at (888) 295-4373 or visit one of our nine locations in Ludington, Frankfort, Hart, Manistee, Onekama, Scottville, or Traverse City.