Fraud Prevention & Alerts

Can you spot a phishing scam?

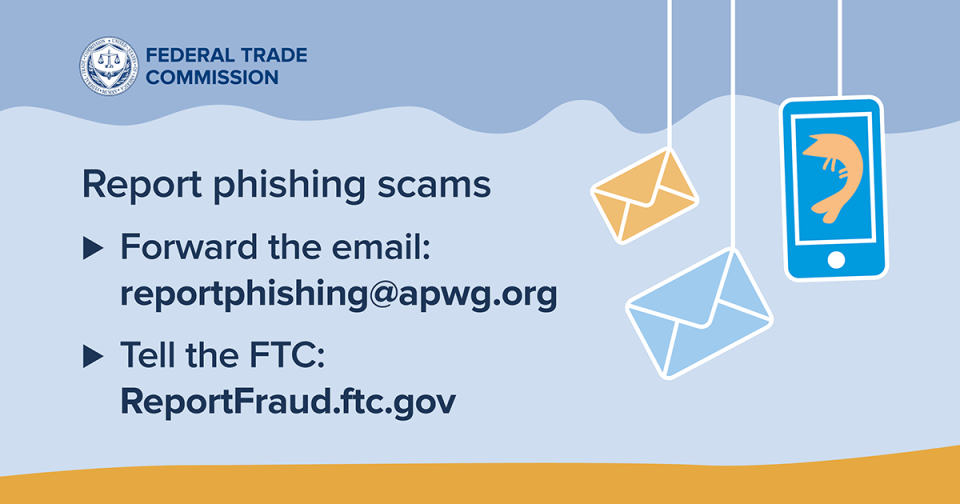

The Federal Trade Commission's Report

Watch Out for the Top 3 Phishing Scams:

- Text Message: If you receive a text message from someone claiming to be your bank and asking you to sign in or offer up personal information, it's a scam. Banks never ask that.

- E-mail: Your bank won't send you e-mails that ask you to click a suspicious link or provide personal information. The sender may claim to be someone from your bank, but it's a scam. Banks never ask that.

- Phone Calls: Your bank would never call you to verify your account number. Banks never ask that. If you're ever in doubt that a caller is legitimate, just hang up and call the bank directly at a number you trust.

- Driver’s license

- Passport and country of issuance

- US taxpayer identification (ID) number

- Alien ID card

- Any other government-issued document evidencing nationality or residence

Fraud Alerts

- Driver's license

- Passport and country of issuance

- S. taxpayer identification (ID) number

- Alien ID card

- Any other government-issued document evidencing nationally or residence

How to Prevent Fraud

Guard your Social Security Number

- Never carry your Social Security card and know your surroundings when disclosing your Social Security number.

- Never provide your Social Security number unless you initiated contact and have confirmed the person or business' identity.

- Do not record your Social Security number on a check, traveler check, gift certificate, etc., unless required by law.

- Do not use any part of your Social Security number as a Personal Identification Number (PIN) or password.

- If you must provide your Social Security number in an email or website, ensure that it is encrypted and know how the recipient will protect it.

Secure Your Computer

- Web browser updates are provided with your security in mind so keep them current.

- Operating system and software patches or service packs should be installed as soon as possible.

- Anti-spyware and anti-virus software helps detect and remove 'bad' software that can steal vital information.

- A firewall prevents unauthorized users from gaining access to the computer or monitoring transfers of information to and from the computer.

- Always use the highest level of security possible when setting up and connecting to wireless networks.

- Never transmit sensitive information over an unencrypted wireless network.

Eliminate Paper

- Sign up for direct deposit and have funds put into your account electronically without paper checks.

- Sign up for e-statements and stop receiving statements and canceled checks in the mail. View them online instead.

- Reduce the amount of mail and paper with your personal information printed on it to minimize the chance of criminals stealing it.

Types of Online Fraud

Malware

- Updated security and system software can protect your computer from malware threats.

- Attachments or free software from unknown sources should not be opened or installed.

- Downloads from file sharing and social networking sites can be sources of malware.

- Pop-up ads asking for personal or financial information are likely fraudulent, so close them.

Phishing or Spoofing

- West Shore Bank emails will never ask you to reply in an email with your personal information and any email that does should raise your concern.

- The message may contain claims that your account will be closed if you fail to confirm, verify or authenticate your personal information. West Shore Bank will not ask you to verify your information in this way.

- Messages about system and security updates claim the Bank needs to confirm important information due to upgrades and states that you must update your information online. West Shore Bank will not ask you to verify information in this way.

- Typos and other errors are often the mark of fraudulent emails or websites. Watch out for typos or grammatical errors, awkward writing, and poor visual design.

- Offers that sound too good to be true often are. You may be asked to fill out a short customer service survey in exchange for money being credited to your account, and you are then asked to provide your account number for proper routing of the supposed credit. West Shore Bank will not request your information in this way.

Money Mules

- Accepting large sums of money into your account for a new job.

- Transferring or wiring funds out of your account to people you do not know.

- Opening a new account to receive money from someone you do not know.

- Overseas companies requesting money transfer agents.

- Vishing

Types of Mobile Fraud

Fake Mobile Banking Apps

- The developer or publisher of the application is West Shore Bank.

- Only download the application from the official 'store' for your device.

- Mobile applications for West Shore Bank are currently free. If there is a charge for the application, it's not legitimate.

SMShing

- Do not respond to a text message that requests personal or financial information; West Shore Bank will never ask you for this.

- Verify the phone number(s) that appear in the text message. Store West Shore Bank in your device contacts for a quick cross-check.

Stolen Devices

- Password protect your device.

- Turn on the screen lock.

- Use a remote wipe application.

- Keep records of the make, model, serial number and IMEI number of your device.

- If your device is stolen, log into Online Banking and remove that device from Mobile Banking.

Recognize Fraud or Identity Theft

- You do not receive an expected bill or statement by mail.

- You see unexpected charges on your account.

- Your credit report contains accounts not yours or has inaccurate information.

- You receive notice that you have been denied credit, but you did not apply for credit.

- There are new accounts on your credit report that are not yours.

- You receive credit cards you did not apply for.

- You receive calls from debt collectors for something you did not buy.

Monitor Your Accounts Regularly

- Over 50 percent of identity fraud is discovered by the victim.

- Customers with electronic access to their accounts detect fraud or identity theft earlier than those who rely on paper statements.

- Customers enrolled in Online Banking that use our email alert functions receive timely notification about activity in their accounts, which can help identify fraud quickly.

- Receiving e-statements instead of paper statements helps reduce the risk of mail fraud.

Check Your Credit Report Annually

Fraudulent Activity

- Call 231-845-3500 or (888) 295-4373

- Or contact your nearest branch

Lost, Stolen, Missing or Found ATM or Debit Card

- Call 231-845-3500 or (888) 295-4373

- Or contact your nearest branch

- Contact ( (888) 297-3416

Phishing Email

- Contact West Shore Bank immediately to close any accounts you believe have been compromised.

- Contact the three major credit bureaus to place a fraud alert on your credit file.

- Equifax – (888) 766-0008

- Experian – (888) 397-3742

- Trans Union – (800) 680-7289

- Close other accounts you know or believe have been opened fraudulently or tampered with.

- File a police report. Get copies to submit to any creditor that may require proof of a crime.

- File your complaint with the FTC.

- For more information about fighting ID theft and reporting fraud, go to www.FTC.gov.

Dealing with a Data Compromise

- West Shore Bank may proactively close your card and issue a new one to help protect your account.

- It does not mean fraud will occur on your account.

- It does not mean you will become a victim of identity theft.

- If you notice any fraudulent charges to your account, contact us immediately by calling 231-845-3500 or (888) 295-4373.

Protect Your Information

- Always know where your card is. If you misplace it, contact us immediately so we can block the card from use.

- Regularly monitoring your account activity is the best way to help detect if you have been a victim of fraud.

- West Shore Bank's Online Banking allows you to access your account at your convenience.

- For added protection, you can set up Online Banking Alerts that notify you about important activity in your accounts, which can help identify fraud quickly.

- Signing up for electronic statements may also help reduce your risk of mail fraud.

- If you receive your statements in the mail, review your statement as soon as possible after it is delivered and immediately report any fraudulent transactions.

EXPLOITING THE CORONAVIRUS: MASSIVE EXCEL PHISHING ATTACK

Microsoft has reported a massive phishing campaign that uses an Excel attachment as bait. The phishing email looks like it is from the Coronavirus Research Center of John Hopkins University–a well known medical organization in the US. The email includes an Excel attachment that is disguised as an updated list of Coronavirus-related deaths, but the file actually contains a hidden piece of malware.

If you open the infected Excel file and click “Enable Content” when prompted, a program called NetSupport Manager will be automatically installed on to your computer. This program is a tool that allows someone to access your computer remotely. Cybercriminals are using NetSupport Manager to gain complete control over a victim’s system; allowing them to steal sensitive data, install more malicious software, and even use the machine for criminal activities. Don’t be a victim!

Here are some ways to protect yourself from this scam:

- Think before you click! The bad guys know that you want to stay up-to-date on the latest COVID-19 data so they use this as bait. They’re trying to trick you into impulsively clicking and downloading their malware.

- Never download an attachment from an email that you weren’t expecting. Remember, even if the sender appears to be a legitimate organization, the email address could be spoofed.

- Always go to the source. Any time you receive an email that claims to have updated COVID-19 data, use your browser to visit the official website instead of opening an attachment or clicking a link.

- If you receive a text message alerting you about suspicious activity on your account, don’t reply to the text message. Contact the financial services institution directly by calling the phone number on their website.

- Never trust your caller ID. Cybercriminals can spoof phone numbers to impersonate someone else.

- Always be cautious of unexpected text messages. While this attack targets Zelle users, this smishing scam could be used with any financial institution.

Identity Theft

- Federal Trade Commission | ftc.gov

- Federal Deposit Insurance Corporation | fdic.gov

- Resources from the Government | idtheft.gov

Consumer Fraud

- Internet Fraud Information | usa.gov

- Federal Bureau of Investigation | fbi.gov

- Consumer Finance Protection Bureau | consumerfinance.gov

.jpg)

.jpg)

.png)

.jpg)